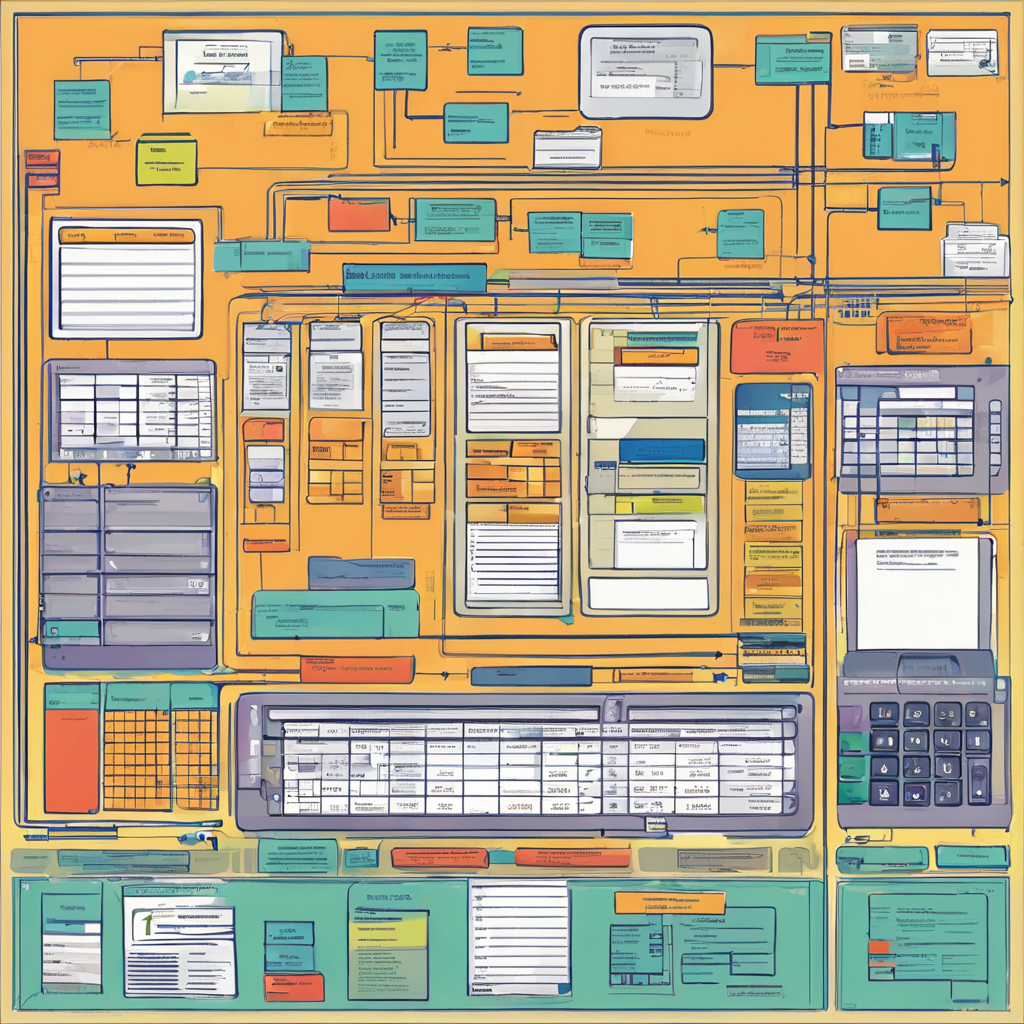

Accounts Payable Workflow Software streamlines the process of managing and tracking financial obligations within organizations. In today’s fast-paced business environment, efficient accounts payable operations are crucial for maintaining cash flow, optimizing vendor relationships, and ensuring compliance with financial regulations. As companies grow and transaction volumes increase, manual accounts payable processes become cumbersome and error-prone. Implementing accounts payable workflow software can automate and streamline these processes, leading to cost savings, improved accuracy, and increased productivity.

One of the key benefits of accounts payable workflow software is automation. By automating routine tasks such as invoice processing, approval routing, and payment scheduling, organizations can significantly reduce the time and resources required to manage accounts payable. Automated workflows can also help eliminate errors and inconsistencies that often arise from manual data entry and processing, leading to greater accuracy in financial records and reporting.

Another advantage of accounts payable workflow software is improved visibility and control. With real-time access to invoice status, payment schedules, and vendor information, finance teams can track and monitor the accounts payable process more effectively. This enhanced visibility allows for better decision-making, proactive issue resolution, and improved cash flow management.

Accounts payable workflow software also enhances collaboration and communication within organizations. By centralizing invoice data and approval workflows in a digital platform, stakeholders across departments and locations can easily access and share information, speeding up the approval process and reducing bottlenecks. Additionally, built-in communication tools enable efficient collaboration between finance teams and vendors, fostering stronger relationships and reducing payment disputes.

In addition to streamlining accounts payable processes, workflow software offers advanced reporting and analytics capabilities. By capturing and analyzing data on invoice processing times, payment trends, and vendor performance, organizations can gain valuable insights into their financial operations and identify areas for improvement. These insights can help drive strategic decision-making, optimize cash flow, and enhance overall financial performance.

Security is another critical aspect of accounts payable workflow software. With sensitive financial data and payment information being processed within the system, robust security measures such as encryption, user authentication, and audit trails are essential to safeguarding against fraud and unauthorized access. Compliance features ensure adherence to regulatory requirements and internal policies, reducing the risk of financial penalties and reputational damage.

Scalability is also a key consideration when selecting accounts payable workflow software. As organizations grow and evolve, the software should be able to adapt to changing business needs and increasing transaction volumes. Scalable solutions can accommodate expanding operations, new vendors, and additional workflows without compromising performance or efficiency.

Integration capabilities are essential for accounts payable workflow software to seamlessly connect with existing financial systems and tools. Integration with enterprise resource planning (ERP) systems, accounting software, and payment platforms enables data synchronization, eliminates duplicate data entry, and enhances overall process efficiency. This interoperability ensures a seamless flow of information across different departments and systems, maximizing the benefits of the software.

Training and support are crucial components of successful accounts payable workflow software implementation. Comprehensive training programs and ongoing support from the software provider help users understand the system’s features, functionalities, and best practices. Regular updates and technical assistance ensure smooth operation and optimal utilization of the software, driving long-term success and ROI for organizations.

In conclusion, accounts payable workflow software offers numerous benefits for organizations looking to streamline and optimize their financial operations. From automation and visibility to collaboration and security, the software provides a comprehensive solution for managing accounts payable processes efficiently. By investing in a robust workflow software solution and leveraging its features effectively, organizations can achieve cost savings, improved accuracy, enhanced productivity, and better financial control.